The March quarter of the year featured continued supply shortages of silicon chips, Covid outbreaks in China and a Russian war on Ukraine. Nevertheless, Apple posted second quarter earnings that showed growth in every sector except for iPad. This is a remarkable achievement of which Tim Cook and his team should be very proud. Apple posted revenue of $97.3 billion and net quarterly profit of $25.0 billion, or $1.52 per diluted share,. This is compared to revenue of $89.6 billion and net quarterly profit of $23.6 billion, or $1.40 per diluted share, in the same quarter last year which is about 9% growth.

“This quarter’s record results are a testament to Apple’s relentless focus on innovation and our ability to create the best products and services in the world,” said Tim Cook, Apple’s CEO, in a statement. “We are delighted to see the strong customer response to our new products, as well as the progress we’re making to become carbon neutral across our supply chain and our products by 2030. We are committed, as ever, to being a force for good in the world — both in what we create and what we leave behind.”

With strong growth in every sector(except iPad due to supply constraints not demand) Apple and Tim Cook have demonstrated remarkable ability to navigate this very difficult economic climate. During the question and answer session, one analyst asked that considering the supply constraints shouldn't Apple be holding more inventory. I smiled when Tim said "In this business, you don't want to hold a ton of inventory. You want to work on cycle times and so-forth to do things very quickly, and take strategic inventory in places where you need to buffer for interruptions and so-forth." I smiled because that is exactly the lesson Small Dog Electronics needed to learn and it was Tim Cook that brought that to Apple. Back in the days when Apple was losing a lot of money, much of that was caused by holding too much inventory that became obsolete with new products and had to be liquidated at a loss. That is directly responsible for Small Dog Electronics success as we would travel the country buying Apple's mistakes in inventory planning. Then Steve Jobs and Tim Cook came along and that was the most immediate change that we saw as that supply chain from Apple quickly dried up. Even back then when Tim was the COO he was a supply chain genius!

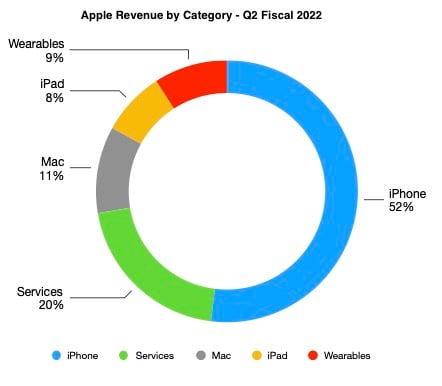

Luca Maestri, Apple’s CFO, said in a statement: “We are very pleased with our record business results for the March quarter, as we set an all-time revenue record for Services and March quarter revenue records for iPhone, Mac, and Wearables, Home and Accessories. Continued strong customer demand for our products helped us achieve an all-time high for our installed base of active devices, Our strong operating performance generated over $28 billion in operating cash flow, and allowed us to return nearly $27 billion to our shareholders during the quarter.”

Apple's board announced an increased dividend payment of $0.23 per share, up from $0.22 per share. The dividend is payable May 12 to shareholders of record as of May 9. The Apple Board also authorized another $90 billion for share-buybacks.

As as been common during the pandemic Apple did not give specific guidance for the next quarter, however; they did indicate that supply chain issues such as Covid and the silicon shortage combined with potential interruptions from the war on Ukraine (Apple stopped selling products in Russia at the start of the war) could reduce 3rd quarter revenue by $-8 billion. Foreign exchange, pandemic, Russia and silicon shortages are a tough nut to crack. Apple talked about the biggest impact in the Shanghai corridor where a lot of manufacturing takes place and even more transportation of goods. Shanghai has been the subject of a gigantic lockdown due to Covid. Apple suppliers are just now getting back to production in some of those areas and we are already ⅓ of the way through the 3rd quarter. I am sure that those same analyst that got beat so badly this quarter will concentrate on that honest assessment in their analysis, but I am also as sure that Apple will navigate those constraints better than any other company and once again Apple will beat the analysts in 3rd quarter results and I will have to come up yet another superlative to describe the results. Congratulations to the entire Apple team!